Summary of expert panel with GBI and Clifford Chance and FAQ

On 8 March 2022 GBI and Clifford Chance held an expert panel on the EU Sustainable Corporate Due Diligence proposal and what it means companies' approaches to respecting human rights. The session covered:

- Which businesses will be in scope, what will the proposal cover and what will the obligations be?

- Is the proposal likely to create a level playing field, harmonisation and legal certainty?

- Do the proposed objectives align with stakeholder expectations? What will they mean for your business?

- What enforcement, remedy, penalties, sanctions, liability and other legal risks will apply?

- How will the proposal impact non-European businesses?

- How are businesses preparing?

Those in attendance will have received a link to the video recording of the panel. For more information, you can find our full FAQ on the proposal below. You can also access the webinar agenda and our latest briefing on 'Navigating a changing legal landscape' (released before publication of the proposal)

SPEAKERS

FAQ on the EU Sustainable Corporate Due Diligence proposal

On 23 February 2022, the European Commission agreed its proposal for a directive on Corporate Sustainability Due Diligence. This FAQ provides an overview of the provisions contained in the proposal. It is not a substitute for the text of the proposal itself.

-

1. WHAT DOES THE PROPOSAL COVER?

The proposal is for a directive setting out rules:

- on obligations of due diligence by companies regarding actual and potential human rights and environmental adverse impacts, with respect to their own operations, the operations of their subsidiaries, and the value chain operations carried out by partners with whom the company has an established business relationship; and

- on liability for violations of the due diligence obligations.

What is a directive?

In European Union law, directives lay down end results to be achieved in every member state, but leave it up to national governments to decide how to adapt their laws to achieve these goals. Each directive specifies the date by which the national laws must be adapted.

What are ‘actual and potential human rights and environmental adverse impacts’?The proposal defines an adverse human rights impact as:

‘…an adverse impact on protected persons resulting from the violation of one of the rights or prohibitions listed in the Annex [to the proposed directive], as enshrined in the international conventions listed in the Annex’.

The international conventions listed include those contained in the International Bill of Human Rights, and the ILO core conventions, among others.

Adverse environmental impacts are defined as:

‘…adverse impact on the environment resulting from the violation of one of the prohibitions and obligations pursuant to the international environmental conventions listed in the Annex’.

You can download a copy of the Annex here.

How is value chain defined?

The proposal defines the value chain as:

‘…activities related to the production of goods or the provision of services by a company, including the development of the product or the service and the use and disposal of the product as well as the related activities of upstream and downstream established business relationships of the company…’.

Certain limitations are placed on the definition of value chain for financial undertakings.

-

2. WHAT COMPANIES ARE IN SCOPE?

The proposal applies to companies who meet the following thresholds:

Table 1: Companies within the scope of the proposal

Group 1

Group 2

Applicable from

(Years from entry into force of directive)

2 years

4 years

Company established in the European Union

Employee threshold

> 500 employees

> 250 employees

Net turnover threshold

> EUR 150 million worldwide

> EUR 40 million worldwide

Sector

All sectors

(specific considerations apply to regulated financial undertakings)

50% of turnover should be generated in one or more high-impact sectors.

Company established outside the European Union

Employee threshold

–

–

Net turnover threshold

> EUR 150 million generated in the EU

> EUR 40 million generated in the EU

Sector

All sectors

(specific considerations apply to regulated financial undertakings)

50% of turnover should be generated in one or more high-impact sectors.

High-impact sectors

- The manufacture of textiles, leather and related products (including footwear), and the wholesale trade of textiles, clothing and footwear;

- Agriculture, forestry, fisheries (including aquaculture), the manufacture of food products, and the wholesale trade of agricultural raw materials, live animals, wood, food, and beverages;

- The extraction of mineral resources regardless from where they are extracted (including crude petroleum, natural gas, coal, lignite, metals and metal ores, as well as all other, non-metallic minerals and quarry products), the manufacture of basic metal products, other non-metallic mineral products and fabricated metal products (except machinery and equipment), and the wholesale trade of mineral resources, basic and intermediate mineral products (including metals and metal ores, construction materials, fuels, chemicals and other intermediate products).

-

3. WHAT ARE THE DUE DILIGENCE OBLIGATIONS?

Article 4 of the proposal outlines the actions companies would be required to take to conduct human rights and environmental due diligence within the meaning of the proposed directive. These are:

- Integrating due diligence into their policies.

- Identifying actual or potential adverse impacts.

- Preventing and mitigating potential adverse impacts, and bringing actual adverse impacts to an end and minimising their extent.

- Establishing and maintaining a complaints procedure.

- Monitoring the effectiveness of their due diligence policy and measures.

- Publicly communicating on due diligence.

Integrating due diligence into company policies (Article 5)

Companies would be required to have in place a due diligence policy that is updated annually. This policy should include:

- A description of the company’s approach, including in the long term, to due diligence.

- A code of conduct describing rules and principles to be followed by the company’s employees and subsidiaries.

- A description of the processes put in place to implement due diligence.

Identifying actual or potential adverse impacts (Article 6)

Companies would be required to take appropriate measures to identify actual or potential adverse human rights and environmental impacts in their own operations, in their subsidiaries and at the level of their established direct or indirect business relationships in their value chain.

Business relationships must be assessed at least annually to determine whether they are of an ‘established’ nature.

Exceptions

- ‘Group 2’ companies (i.e. those in high-impact sectors which do not reach the higher employee and turnover thresholds) would only be required to identify actual and potential severe adverse impacts relevant to the respective sector. A severe adverse impact is defined in a manner that reflects the UNGPs considerations of ‘scale, scope and irremediable character’:

‘an…impact that is especially significant by its nature, or affects a large number of persons or a large area of the environment, or which is irreversible, or is particularly difficult to remedy as a result of the measures necessary to restore the situation prevailing prior to the impact.’

- Financial undertakings would only be required to identify actual and potential adverse impacts before providing credit, loans or other financial services. In this context, the value chain only includes the client’s activities, and of other companies belonging to the same group whose activities are linked to the contract in question. The value chain of financial undertakings excludes SMEs to whom they provide services.

Preventing potential adverse impacts (Article 7) and bringing actual adverse impacts to an end (Article 8)

Articles 7 and 8 establish the actions companies would be required to take to prevent potential impacts or end actual impacts. The actions are similar in both cases, and are summarised in the below table:

Table 2: Key provisions of Articles 7 and 8

Preventing potential adverse

impacts(Article 7)

Bringing actual adverse impacts to an end

(Article 8)

Companies would be required to take appropriate measures to:

A. Prevent potential adverse impacts that have been identified (or that should have been) or to adequately mitigate those impacts, where prevention is not possible or requires gradual implementation.

B. Bring to an end actual adverse impacts that have been identified (or that should have been). Where this is not possible, companies would be required to minimise the extent of such an impact.

In each case, companies would be required to take the following steps, where relevant:

1. Neutralise the adverse impact or minimise its extent, including by the payment of damages to the affected persons and of financial compensation to the affected communities.

The action shall be proportionate to the significance and scale of the adverse impact and to the contribution of the company’s conduct to the adverse impact.

- Develop and implement a prevention action plan, where necessary due to the nature or complexity of the measures required for action (Art 7) or due to the fact that the adverse impact cannot be immediately brought to an end (Art 8)

- The plan should have reasonable and clearly defined timelines for action.

- Qualitative and quantitative indicators for measuring improvement should be included.

- The plan shall be developed in consultation with affected stakeholders.

- Seek contractual assurances from a business partner with whom it has a direct business relationship that it will ensure compliance with the company’s code of conduct and, as necessary, a prevention action plan, including by seeking corresponding contractual assurances from its partners, to the extent that their activities are part of the company’s value chain (contractual cascading).

- Contractual assurances shall be accompanied by the appropriate measures to verify compliance.

- For the purposes of verifying compliance, the company may refer to suitable industry initiatives or independent third-party verification.

- When contractual assurances are obtained from a micro- small- or medium-sized enterprise (SME), the terms shall be fair, reasonable and non-discriminatory.

- Where measures to verify compliance are carried out in relation to SMEs, the company should bear the cost of the independent third-party verification.

- Contractual assurances shall be accompanied by the appropriate measures to verify compliance.

4. Make necessary investments, such as into management or production processes and infrastructures, to prevent, end, neutralise or minimise impacts, as appropriate.

5. Provide targeted and proportionate support for an SME with which the company has an established business relationship, where compliance with the code of conduct or the prevention action plan would jeopardise the viability of the SME.

6. In compliance with EU law including competition law, collaborate with other entities, including, where relevant, to increase the company’s ability to bring the adverse impact to an end, in particular where no other action is suitable or effective.

7. Where an actual adverse impact could not be brought to an end or adequately mitigated by the measures outlined above, the company may seek to conclude a contract with a partner with whom it has an indirect relationship, with a view to achieving compliance with the company’s code of conduct or a corrective action plan.

In such cases, the considerations in relation to contractual assurances outlined above also apply.

Preventing potential adverse impacts

(Article 7)

Bringing actual adverse impacts to an end

(Article 8)

- If the company cannot prevent, end, or adequately mitigate or minimise the potential adverse impacts through the actions outlined above, the company would be required to refrain from entering into new or extending existing relations with the partner in connection to or in the value chain of which the impact has arisen.

Where the law governing their relations entitles them to do so, companies shall take the following actions:

- Temporarily suspend commercial relations with the partner in question, while pursuing prevention and minimisation efforts, or efforts to bring to an end or minimise an actual adverse impact, if there is reasonable expectation that these efforts will succeed in the short-term; or

- Terminate the business relationship with respect to the activities concerned if the potential or actual adverse impact is severe.

The proposal would require Member States to provide for the availability of an option to terminate the business relationship in contracts governed by their laws. Financial undertakings shall not be required to terminate the credit, loan or other financial service contract when this can be reasonably expected to cause substantial prejudice to the entity to whom the service is being provided.

Complaints procedure (Article 9)

Under the proposal, companies would be required to provide the possibility to submit complaints to the company where they have legitimate concerns regarding actual or potential adverse human rights impacts and adverse environmental operations with respect to their own operations, the operations of their subsidiaries and their value chains.

Complaints procedures should be open to

- Persons affected by an adverse impact, or those who have reasonable grounds to believe they might be so affected.

- Trade unions and other worker’s representatives representing individuals working in the value chain.

- Civil society organisations active in an area related to the company’s value chain.

Companies would be required to have procedures in place, including for when it considers a complaint to be unfounded, and should inform relevant workers and trade unions of these procedures.

Complainants would be entitled to request appropriate follow-up from the company, and to meet with the company’s representatives at an appropriate level to discuss the subject matter of the complaint.

Monitoring (Article 10)

Companies would be required to carry out periodic assessments of their own operations and measures, those of their subsidiaries and, where related to the value chains of the company, those of their established business relationships.

These assessments should monitor the effectiveness of the identification, prevention, mitigation, bringing to an end and minimisation of the extent of human rights and environmental adverse impacts.

Such assessments shall be based, where appropriate, on qualitative and quantitative indicators and be carried out at least every 12 months and whenever there are reasonable grounds to believe that significant new risks of the occurrence of those adverse impacts may arise.

The company’s due diligence policy shall be updated in accordance with the outcome of those assessments.

Communicating (Article 11)

Companies that do not already report under the Non-Financial Reporting Directive would be required to report on the matters covered by this directive by publishing on their website, by 30 April each year, an annual statement in a language customary in the sphere of international business.

The content and criteria for such reporting would be outlined by the European Commission in separate delegated legislation.

-

4. WHAT DOES THE PROPOSAL SAY ABOUT CLIMATE CHANGE?

The proposal would require ‘Group 1 companies’ (see Table 1, above) to adopt a plan to ensure that the business model and strategy of the company are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5ºC in line with the Paris Agreement (Art. 15).

Such a plan should identify, on the basis of reasonably available information, the extent to which climate change is a risk for, or an impact of, the company’s operations.

Where climate change is a principal risk for, or principal impact of, the company’s operations, the company should include emission reduction objectives in its plan.

The fulfilment of these obligations should be taken into account when setting variable remuneration for directors, if such remuneration is linked to the contribution of a director to the company’s business strategy, long-term interests and sustainability.

-

5. WHAT SUPPORT MEASURES WILL BE PUT IN PLACE?

If the proposal is approved, the European Commission would adopt guidance about voluntary model contractual clauses that companies could utilise in relation to Articles 7 and 8, outlined above (Art. 12).

The European Commission may also issue guidelines on how companies should fulfil their due diligence obligations, including for specific sectors or specific adverse impacts (Art. 13).

A range of other supporting measures are envisioned, including websites, platforms or portals to provide information and support to companies and the partners in their efforts to fulfil the obligations outlined above, financial support for SMEs in the value chains of companies covered by the proposal, and measures at EU-level to support due diligence, including joint stakeholder initiatives (Art. 14).

The proposal provides that companies may rely on industry schemes and multi-stakeholder initiatives to support the implementation of their obligations, where these are ‘appropriate to support the fulfilment of those obligations’. Guidance may be made available by the European Commission in this respect (Art. 14).

Companies established outside the European Union would be required to designate an authorised representative within the European Union for the purposes of the Directive (Art. 16).

-

6. WHO WILL SUPERVISE COMPLIANCE, AND WILL SANCTIONS APPLY?

The proposal provides that each Member State shall designate one or more supervisory authorities to supervise compliance with the obligations laid down in national provisions adopted pursuant to the directive (Art. 17).

A supervisory authority may initiate an investigation on its own motion, or as a result of substantiated concerns communicated to it, where it considers that it has sufficient information indicating a possible breach by a company of the obligations provided for. Supervisory authorities may conduct inspections, and shall assist each other in cross-border inspections (Art. 18).

What is a substantiated concern?

Natural and legal persons would be entitled to submit a ‘substantiated concern’ to a supervisory authority, when they have reason to believe, on the basis of objective circumstances, that a company is failing to comply with the relevant obligations outlined above.

Such persons will be informed of the result of and reasoning for the assessment of their substantiated concern by the supervisory authority.

Where such persons have a legitimate interest in the matter, they shall also have access to a court or other impartial public body which can review the decisions, acts or failure to act of the supervisory authority (Art. 19). The Whistleblower Directive applies. (Art. 23).

Where a supervisory authority identifies a failure to comply with the obligations, the company concerned would be granted an appropriate period of time to take remedial action, if such action is possible. However, taking remedial action does not preclude the imposition of administrative sanctions or the triggering of civil liability in case of damages (Art. 18).

Sanctions that are effective, proportionate and dissuasive should be provided for in national legislation. Due account shall be taken of the company’s efforts to comply with any remedial action required by a supervisory authority, any investments made and targeted support provided, pursuant to Articles 7 and 8, as well as collaboration with other entities to address adverse impacts in its value chains. If sanctions are monetary, they should be based on the company’s turnover. Any decision to impose sanctions should be published by the supervisory authority. (Art. 20). Companies applying for public support must certify no sanctions have been imposed on them under the directive (Art. 24).

-

7. IN WHAT CIRCUMSTANCES CAN CIVIL LIABILITY ARISE?

The proposal provides that companies shall be liable for damages if:

- They failed to comply with the obligations laid down in Article 7 and 8, and

- As a result of this failure an adverse impact that should have been identified, prevented, mitigated, brought to an end or its extent minimised through the appropriate measures laid down in Articles 7 and 8 occurred and led to damage.

Seeking contractual assurances in accordance with Articles 7 and 8 will ensure that a company is not be liable for damages caused by an adverse impact arising as a result of the activities of an indirect partner with whom it has an established business relationship, unless it was unreasonable, in the circumstances of the case, to expect that the action actually taken, including as regards verifying compliance, would be adequate to prevent, mitigate, bring to an end or minimise the extent of the adverse impact.

Due account shall be taken of the company’s efforts, insofar as they relate directly to the damage in question, to comply with any remedial action required of them by a supervisory authority, any investments made and any targeted support provided pursuant to Articles 7 and 8, as well as any collaboration with other entities to address adverse impacts in its value chains.

The civil liability of a company for damages shall be without prejudice to the civil liability of its subsidiaries or of any direct and indirect business partners in the value chain, and are also without prejudice to stricter EU or national rules.

-

8. WHAT DOES THE PROPOSAL SAY ABOUT DIRECTORS’ DUTIES?

The proposal would require an amendment to Member State company law to ensure that, when fulfilling their duty to act in the best interest of the company, directors of EU-established in-scope companies take into account the consequences of their decisions for sustainability matters, including, where applicable, human rights, climate change and environmental consequences, including in the short, medium and long term. Failure to do so should constitute a breach of directors’ duties under national law (Art. 25).

In addition, directors should be responsible for putting in place and overseeing the due diligence actions referred to in Article 4 and in particular the due diligence policy referred to in Article 5, with due consideration for relevant input from stakeholders and civil society organisations. The directors shall report to the board of directors in that respect. Directors should take steps to adapt the corporate strategy to take into account the actual and potential adverse impacts identified pursuant to Article 6 and any measures taken pursuant to Articles 7 to 9 (Art. 26).

For the purposes of the proposal, a director is any member of the administrative, management or supervisory bodies of a company, the chief executive officer and, if such function exists in a company, the deputy chief executive officer and other persons who perform functions similar to those roles.

-

9. WHAT HAPPENS NEXT?

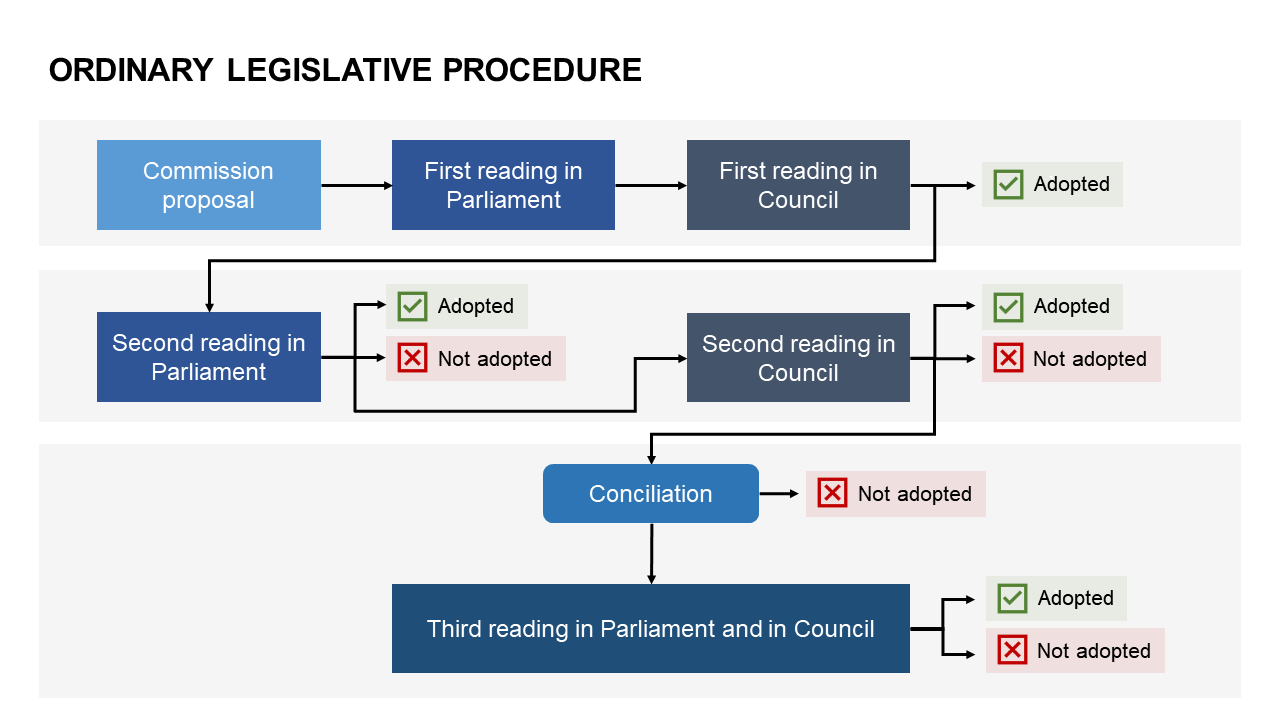

The proposal will follow the European Union’s ordinary legislative procedure (previously called ‘codecision’). Under the procedure, the next steps are as follows:

- The European Parliament and the Council of the European Union (‘Council’) review the European Commission’s proposal in turn and may propose amendments.

- If the two institutions agree on the text, the proposed legislation can be adopted.

- If they cannot agree, a second reading takes place and either institution can propose amendments.

- At this stage, the European Parliament has the power to reject the proposed legislation outright if it cannot agree with the Council.

- If these two institutions agree on amendments, the proposed legislation can be adopted.

- If they cannot agree, a conciliation committee works to find a solution, and the joint text is examined by both the European Parliament and the Council.

- Either institution can block a legislative proposal at its final reading.

- If they agree, the proposal becomes law. It will enter into force twenty days after its publication in the European Union’s Official Journal.

- Member States would then have 2 years to transpose the directive into their national law. Certain latitude is afforded to Member States in the directive, meaning there may be slight variation across countries.

- The national legislation would apply to companies with more than 500 employees and a turnover of more than EUR 150 million (as well as non-EU companies with net turnover of more than EUR 150 million in the EU) two years after the directive enters into force.

- The national legislation would apply to companies in the high-impact sectors four years after the directive enters into force.

A more detailed overview of the ordinary legislative procedure process is available on the European Parliament’s website.

The Commission will review the implementation of the directive seven years after its entry into force (Art 29). That review will evaluate the effectiveness of the directive and will assess:

- Whether the thresholds regarding the number of employees and net turnover need to be lowered.

- Whether the list of high-impact sectors needs to be changed.

- Whether the Annex needs to be modified, including in light of international developments.

- Whether Articles 4 to 14 should be extended to adverse climate impacts.

- The European Parliament and the Council of the European Union (‘Council’) review the European Commission’s proposal in turn and may propose amendments.

DISCLAIMER: No aspect of this document constitutes legal or commercial advice, nor should it be relied upon as such. The content of this document is for general informational purposes only. If you require professional advice, please seek support from a qualified legal or commercial advisor.